Bitcoin, Ether, and XRP ETFs see renewed inflows, but onchain data signals weakening conviction

Crypto markets entered 2026 with renewed optimism as spot ETF inflows turned positive again, offering price stability after a volatile end to 2025. While institutional capital has returned across major digital assets, analysts caution that the market is increasingly supported by flows rather than strong underlying conviction.

ETF Inflows Support Prices Across Major Assets

Between Dec. 29 and Jan. 2, spot Bitcoin ETFs recorded $459 million in net inflows, accompanied by roughly $14 billion in trading volume. Ether ETFs attracted $161 million, while XRP ETFs added $43 million, signaling renewed institutional engagement as portfolios reset for the new year.

During this period, Bitcoin consolidated below key resistance near $92,000 before trading around $93,000, while Ether held near $3,200. Broader altcoin performance remained mixed, reflecting cautious positioning rather than widespread risk appetite.

Onchain Metrics Signal Market Fatigue

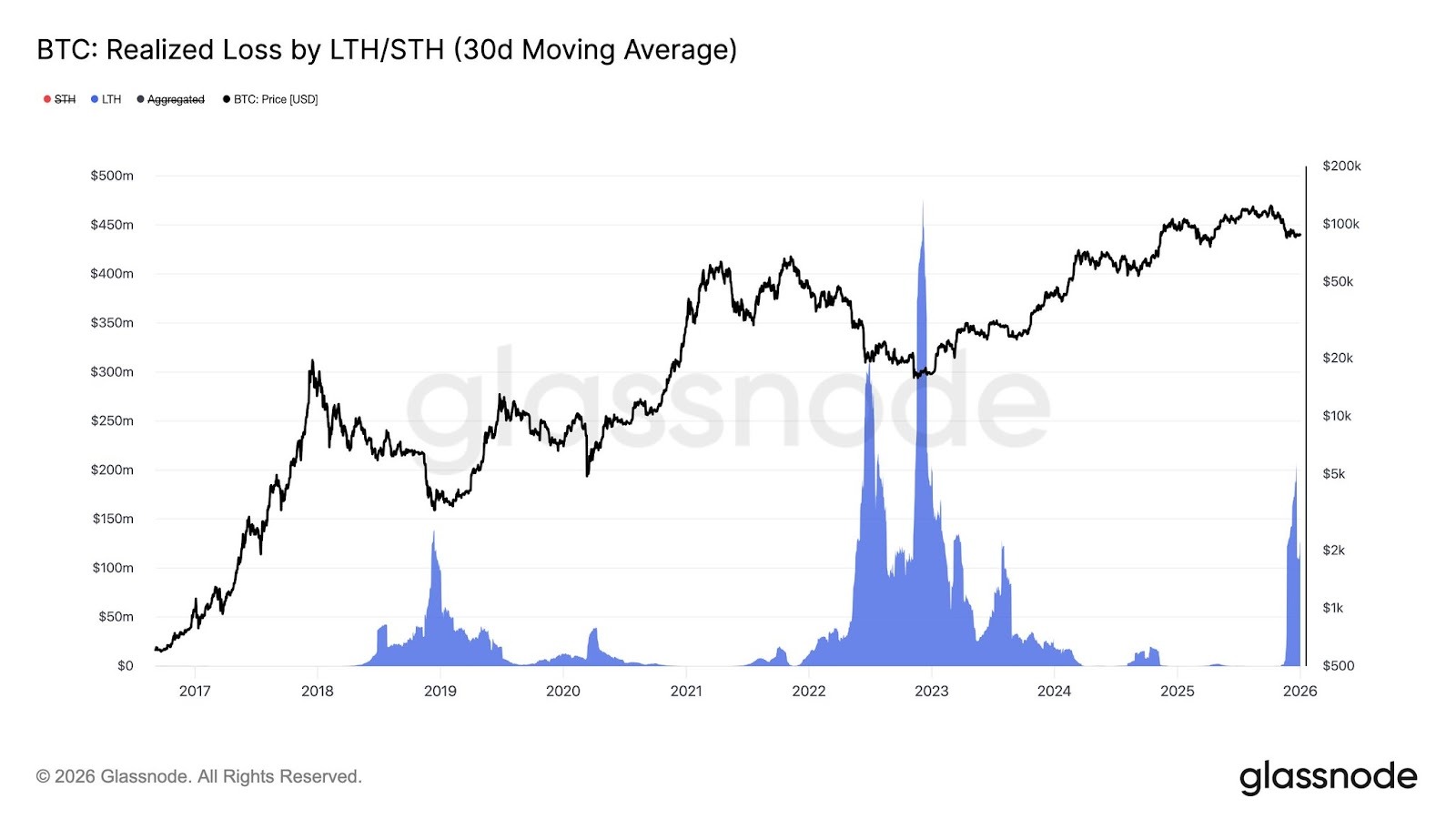

Despite supportive ETF flows, onchain indicators have weakened. The 30-day change in Bitcoin’s realized capitalization turned negative in late December, ending one of the longest periods of sustained capital inflows. At the same time, long-term holders have increasingly realized losses, even as prices remained relatively stable.

Analysts describe this phase as a late-cycle environment where time, not fear, drives selling pressure. While ETF inflows may limit downside risk, sustained upside will likely require renewed onchain capital formation rather than reliance on secondary market demand alone.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.