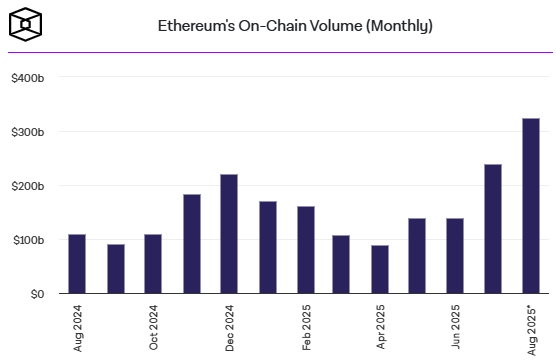

Ethereum activity surged in August 2025, recording over $320 billion in onchain transaction volume, the highest level since May 2021. This marks the third-largest month on record for the Ethereum blockchain, according to The Block’s data dashboard.

Ethereum Network Activity Reaches Multi-Year Peaks

Ethereum’s onchain transfer volume measures economic activity such as transfers, DeFi interactions, and other blockchain transactions. In August, the network also saw:

- 30-day transaction counts hitting fresh highs

- Monthly active ETH addresses at their second-highest ever

- Total Value Locked (TVL) near all-time highs

This surge reflects growing institutional interest, ETF inflows, and favorable network conditions.

Corporate Treasuries and ETF Inflows Drive Demand

One major factor fueling this growth is corporate Ether accumulation. Public companies increased their Ether holdings from $4 billion in early August to over $12 billion by month-end.

Key contributors included BitMine Immersion and SharpLink Gaming, signaling institutional confidence in Ethereum.

Meanwhile, spot ETH ETFs reported significant inflows, with volumes peaking in late August. Collectively, ETF products now hold over 5% of Ethereum’s total supply, highlighting investor appetite.

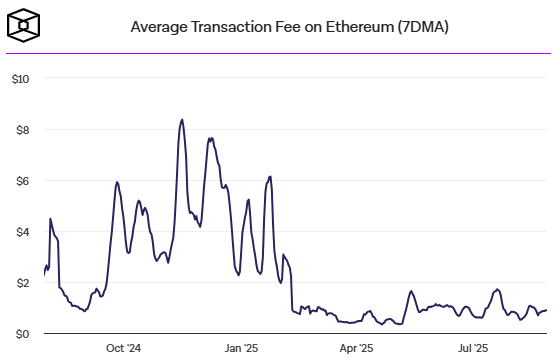

Low Fees and Upgrades Boost Network Usability

Ethereum’s average transaction fees are near a five-year low, thanks to the Dencun upgrade (March 2024) which introduced EIP-4844 (proto-danksharding), reducing data costs for rollups.

The Pectra upgrade, launched this year, further enhanced account abstraction, developer tooling, and user experience, paving the way for greater scalability and adoption.

Validator Activity and Liquid Restaking Surge

Validator dynamics also contributed to the uptick in network activity. Exit requests hit a record high, while entry requests reached a two-year peak. Many withdrawals flowed into liquid restaking protocols, which accumulated tens of billions in assets this summer, optimizing yield and liquidity for stakers.

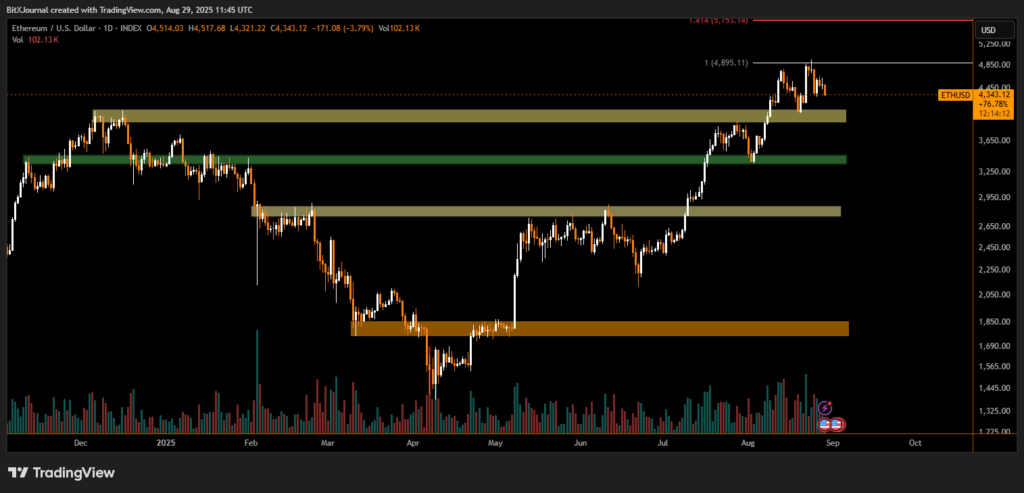

Despite the strong onchain metrics, ETH currently trades around $4,337, about 12% below its all-time high, after recent corrections. Analysts at Standard Chartered argue Ethereum remains undervalued given its growing institutional adoption, ETF demand, and infrastructure upgrades.

Key Takeaways

- $320B onchain volume in August – highest since 2021

- Corporate ETH holdings tripled to $12B

- ETH ETFs now hold over 5% of supply

- Network fees near 5-year lows after Dencun and Pectra upgrades

Ethereum’s multi-year highs in usage, institutional accumulation, and ETF demand suggest strong fundamentals, even as price consolidates.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.