Tokenized stocks remain a nascent segment of crypto markets, but recent trading data shows activity is rapidly concentrating around a small number of centralized exchanges. As blockchain-based equities gain traction, Kraken and Bitget have emerged as early leaders, shaping liquidity and market structure while U.S.-based platforms remain sidelined by regulation.

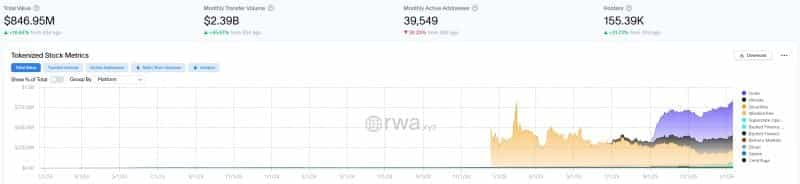

According to recent data onchain public equities now represent nearly $850 million in total value, with monthly trading volumes around $2.4 billion and more than 155,000 holders. Activity accelerated notably in the second half of 2025, signaling growing demand for blockchain-based access to traditional stocks and ETFs.

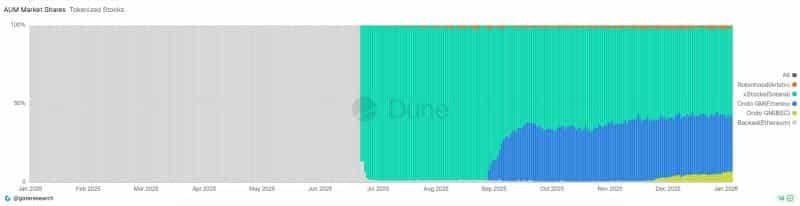

Kraken was among the first major exchanges to scale tokenized equities through its xStocks platform, offering tokenized exposure to U.S. stocks and ETFs with fractional ownership and extended trading hours. Since launch, users have traded over $5 billion in tokenized equities, including more than $1 billion in onchain transactions, giving Kraken a strong early foothold despite ongoing U.S. access restrictions.

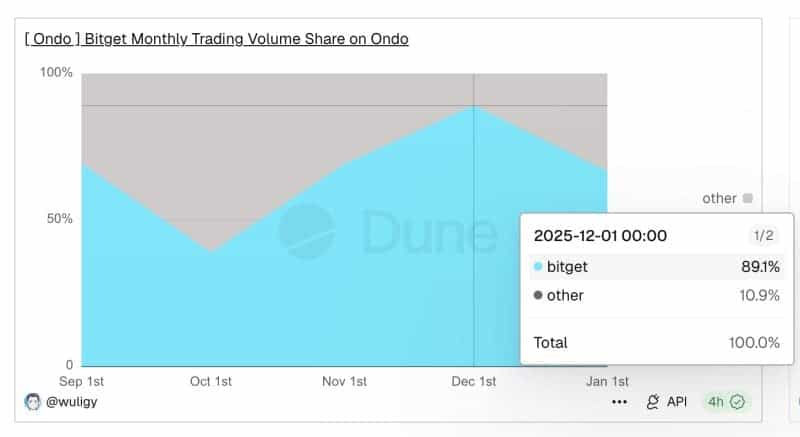

Bitget took a different approach by partnering with Ondo Finance, focusing on rapid issuance and distribution. Bitget has recorded nearly $1 billion in cumulative tokenized stock volume, accounting for close to 90% of global trading volume in Ondo-issued stocks during peak months. Notably, Ondo now leads by total onchain supply, surpassing Kraken in issued tokenized equity value.

While non-U.S. platforms currently dominate, analysts point out that distribution will likely determine the next growth phase. If large U.S. platforms eventually receive approval, tokenized stock volumes could scale rapidly, reshaping how global investors access traditional equities through blockchain infrastructure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.